kansas sales tax exemption certificate

For other Pennsylvania sales tax exemption certificates go here. Or Designated or Generic Exemption Certificate ST-28 that authorizes exempt purchases of services.

If your company is exempt from sales tax.

. Florida Kansas and Missouri. I hereby certify that I hold valid Kansas sales tax registration number and I am in the business of selling. Kansas Vermont and Rhode Island are part.

How to use sales tax exemption certificates in Tennessee. Exemption certificates must be obtained from the purchaser at the time of the sale. For other Colorado sales tax exemption certificates go here.

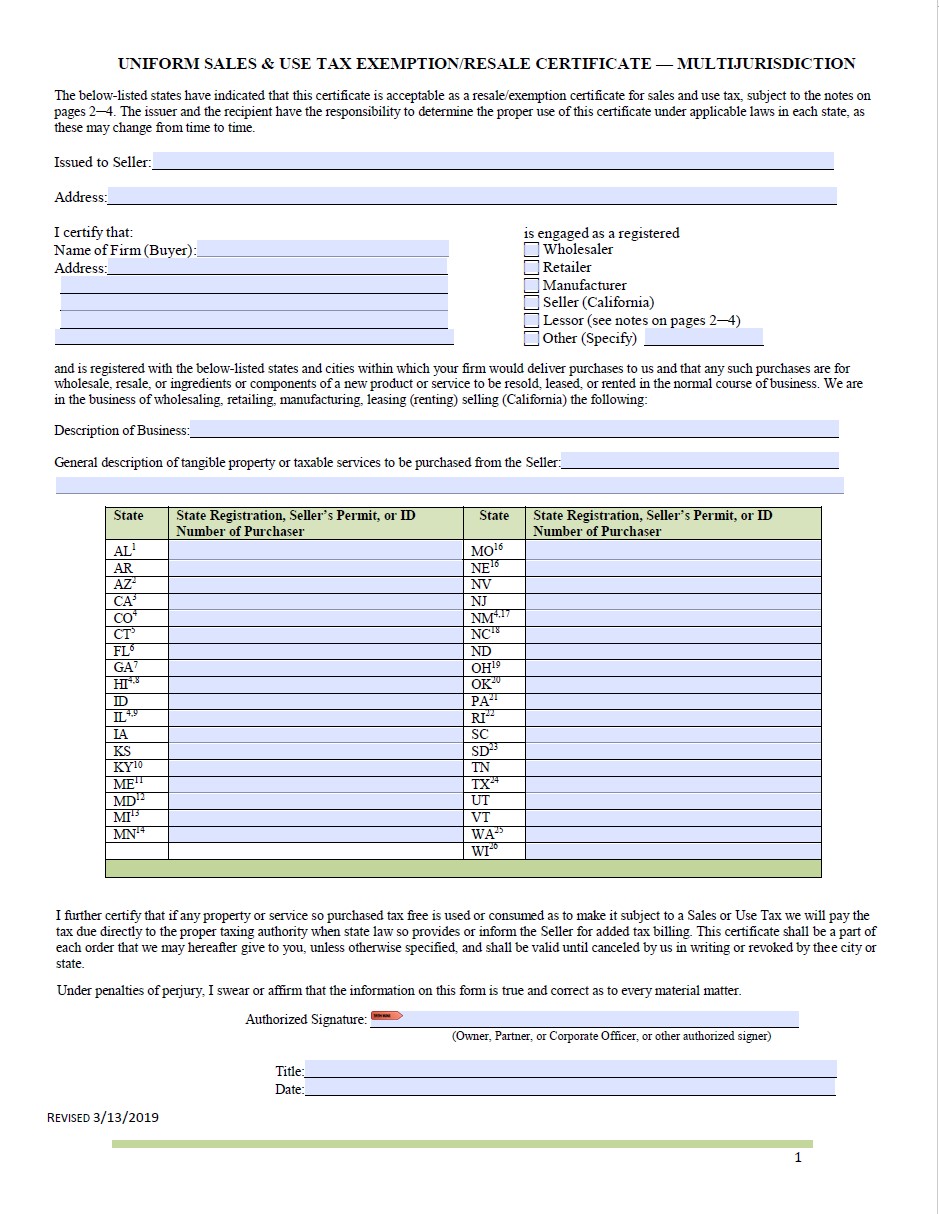

The Sales Tax Permit and Sales Tax Exemption Certificate is commonly thought of as the same thing but they are actually two separate documents. The below-listed states have indicated that this certificate is acceptable as a resaleexemption certificate for salesuse tax subject to the instructions. The Sales Tax Exemption Certificate is the form you should use to claim exemptions in Pennsylvania.

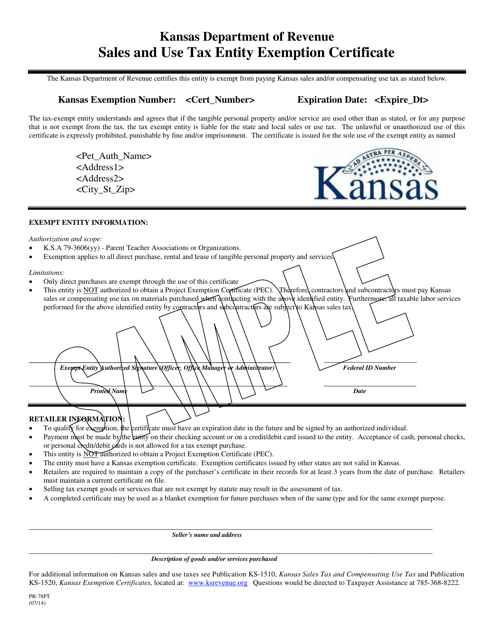

Kansas Department of Revenue-issued tax-exempt entity sales tax exemption certificate showing state-issued exempt organization ID number Form PR-78SSTA. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax. State Issued Exemption Certificate with. Sales tax rules for craft fair sellers.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. By me in the form of tangible personal property or repair service. The form serves multiple purposes and can be used for both one-time transactions and as a blanket exemption certificate for similar purchases from the same seller.

The sales tax number allows a business to sell and collect sales tax from taxable products and services in the state while the resale certificate allows the retailer to make tax-exempt purchases for products they intend to resell. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. How to use sales tax exemption certificates in Arizona.

On the listing form check the box beside Charge sales tax according to the sales tax table. If your business is on the hook for sales tax in a growing number of states consider automating exemption certificate management. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

The below-listed states have indicated that this certificate is acceptable as a resaleexemption certificate for salesuse tax subject to the instructions. The sales tax license allows a business to sell and collect sales tax from taxable products and services in the state while the exemption certificate allows the retailer to make tax-exempt purchases for products they. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. SUT Account Number. Oklahoma Sales Tax Exemption Certificate Unlike a Value Added Tax VAT the Oklahoma sales tax only applies to end consumers of the product.

Although theres no state sales tax in Alaska many municipalities have a local sales tax and policies vary by locality. Purchaser must enter a valid Kansas Registration Number issued by the Kansas Department of Revenue. Colorado allows a retailer to accept an exemption certificate issued by another state.

Kansas Department of Revenue - opens in new window or tab. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Unless there is a valid exemption.

State issued exemption certificate. The certificate is also sometimes referred to as. If a non-Colorado-based retailer buying from a Colorado-based seller or the consumer has an exemption certificate issued by another state then the seller is not bound to collect the sales tax from.

Diplomatic Sales Tax Exemption Cards The Departments Office of Foreign Missions OFM issues diplomatic tax exemption cards to eligible foreign missions and their accredited members and dependents on the basis of international law and reciprocity. These cards facilitate the United States in honoring its host country obligations under the Vienna Convention on Diplomatic. How to use sales tax exemption certificates in Texas.

How to use sales tax exemption certificates in Kansas. RESALE EXEMPTION CERTIFICATE 465718 The undersigned purchaser certifies that the tangible personal property or service purchased from. An Indiana Sales Tax Exemption Certificate is a document that allows a business to purchase goods and services tax-free from suppliers for the purpose of reselling those goods and services.

Individuals and companies who are purchasing goods for resale improvement or as raw materials can use a Oklahoma Sales Tax Exemption Form to buy these goods tax-free. How to use sales tax exemption certificates in Pennsylvania. The Sales Tax Permit allows a business to sell and collect sales tax from taxable products and services in the state while the Exemption Certificate allows the retailer to make tax-exempt purchases.

In many states but not all states the purchase of goods and services by state or local governments or by nonprofits are exempt from sales tax. Companies or individuals who wish to make a qualifying. Printable Florida Example Sales Tax Exemption Certificate Form DR-13 for making sales tax free purchases in Florida.

How to use sales tax exemption certificates in Virginia. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. The sales tax number and resale certificate are commonly thought of as the same thing but they are actually two separate documents.

Absent strict compliance with these requirements Oklahoma holds a seller liable for sales tax due on sales where the claimed exemption is found to be invalid for whatever reason unless the Tax Commission determines that purchaser should be pursued for collection of the tax resulting from improper presentation of a certificate. In the Kenai Peninsula Borough for example all sellers are REQUIRED to register for sales tax collection emphasis theirs including sellers at temporary events. First four digits of GSA CC or a Hard Copy of your PO.

Purchaser must enter a valid Kansas Registration Number issued by the Kansas Department of Revenue. Exemption certificates must be obtained from the purchaser at the time of the sale. The entire Form ST-28H including the direct purchase portion must be.

In its most basic form a sales tax exemption certificate alleviates a company from collecting and remitting sales tax on certain products and services. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

The sales tax license and exemption certificate are commonly thought of as the same thing but they are actually two separate documents. Of the 45 states plus the District of Columbia with a general sales tax only three have not adopted some form of economic nexus.

Pin On Fillable Department Of Motor Vehicles Dmv Forms

Reg 256 Fillable Forms Facts Form

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller

What Is A Sales Tax Exemption Certificate And How Do I Get One

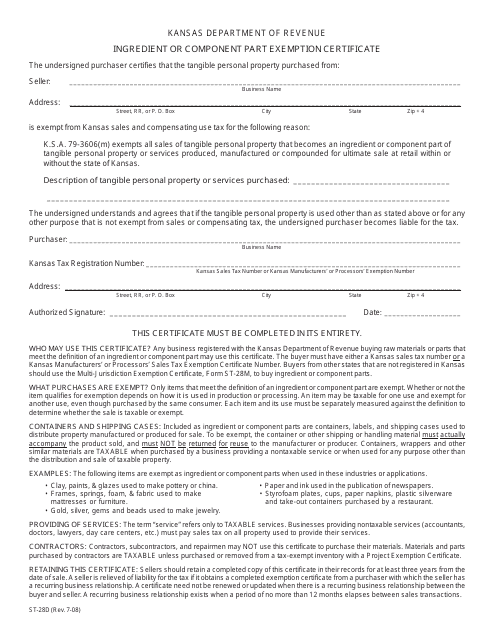

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate Kansas Templateroller

Form Pr 78pt Download Printable Pdf Or Fill Online Sales And Use Tax Entity Exemption Certificate Parent Teacher Association Sample Kansas Templateroller

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors